Stamp Duty Land Tax (SDLT), the tax levied on property purchases, is set to see significant changes starting from 1 April 2025.

These revisions are particularly important for those purchasing additional properties or considering buy-to-let investments, as the tax implications will be felt most acutely by this group.

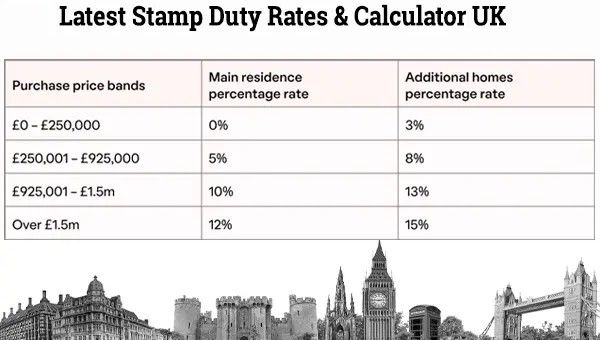

Currently, SDLT for second homes and investment properties includes a higher tax rate compared to residential properties for primary use. For example, the SDLT rate on properties priced between £250,000 and £925,000 for second homes will rise from 3% to 5%. While this may seem like a modest increase, the effect on the overall transaction costs can be substantial. For instance, on a property purchase of £500,000, an investor will see an increase in SDLT from £15,000 (under current rates) to £25,000 (under the new rates) once these changes come into effect. As more investors target the buy-to-let market, these increased costs could affect their return on investment.

The change will also impact the Additional Properties in England.

As of 1 April 2025, new rates will see an adjustment to this system, notably introducing a new tax band at £125,000, at which properties will incur a 7% SDLT rate.

This change will affect buyers of properties valued above the £125,000 threshold, adding a layer of financial complexity to the decision-making process.

Changes Affecting First-Time Buyers

Although these updates primarily target second homes and investors, it is also important to note the impact on first-time buyers. The nil-rate threshold for first-time buyers will be reduced from £425,000 to £300,000.

Also, the maximum property value eligible for first-time buyer relief will decrease from £625,000 to £500,000. Purchasers of properties exceeding this new threshold will face higher SDLT rates.

Though this shift mainly affects first-time buyers, it could also influence the demand for affordable homes within this bracket.

Contact us today

Understanding the 2025 stamp duty changes, assessing their financial impact, and implementing strategies to manage increased costs are crucial for home buyers and investors. Our experienced property advisers can guide you through the process and help you navigate the complexities of the new SDLT rates.

Looking to Sell or Let your property?

Our team of local experts are here to help you.